2024 © First Canadian Financial Group. All Rights Reserved.

The Office of the Superintendent of Financial Institutions (OSFI) sets out expectations for public disclosure of an insurer’s capital, risk position and financial condition. First Canadian Insurance Corporation’s (First Canadian or the Company) primary regulator is the Alberta Superintendent of Financial Institutions who has adopted OSFI’s Guideline with respect to the Life Insurance Capital Adequacy Test Public Disclosure Requirements. The OSFI guideline requires the LICAT disclosure to be published annually.

First Canadian operates three lines of business: Creditor Group, Employee Group Benefits and Individual Term Life (operating as Mosaic Life).

Group creditor insurance includes: life; disability; critical illness; and critical period disability that provide insurance against the outstanding debt at the onset of an insurable event. These products are sold principally through independent automotive or recreational vehicle dealerships.

Employee Group Benefits includes: basic, dependent, and optional life; basic and optional accidental death and dismemberment (“AD&D”); critical illness; short-term disability (“STD”); long-term disability (“LTD”); extended heath care, out of country medical (“OOCM”); and dental coverage.

Mosaic Life includes term life insurance with 10 year minimum coverage, available up to 65 years of age. This product is sold directly to customers via an online platform.

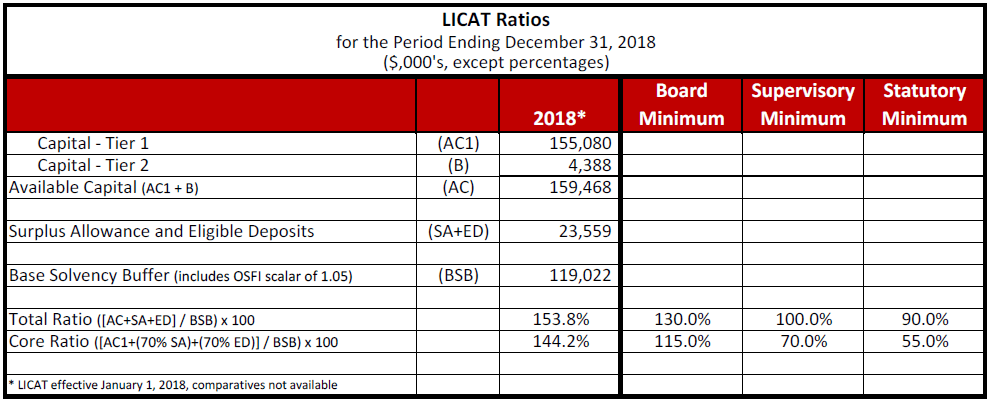

Capital and the capital ratios were determined using OSFI’s LICAT framework calculated by the First Canadian’s independent Appointed Actuary. The LICAT is a key measure of an insurer’s financial condition and their ability to meet their future policyholder benefits and creditor obligations. OSFI has established statutory and supervisory minimums and expects the Company’s Board of Directors to establish an internal minimum at a level above the supervisory minimum which is reflective of the Company’s risk appetite and risk tolerance given the insurer’s size and complexity.

Available Capital: Includes Tier 1 Capital consisting primarily of common equity and retained earnings adjusted for Tier 2 Capital. First Canadian’s Tier 2 capital consists of a negative charge for intangible assets and a positive charge for negative reserves. Surplus Allowances, primarily the gross provision for adverse deviation contained within the valuation reserves, is added to the available capital to complete the LICAT ratio numerator.

The Base Solvency Buffer: Required capital, is comprised of five risk components, described below, reduced by a diversification credit and then increased by the Regulators scalar margin of 5%. The Regulator has established the required capital at a level equal to a CTE (conditional tail expectation) of 99% over a one-year time horizon

Market Risk: Is the risk that arises from changes in rates or market prices in various markets and includes interest rate, equity, preferred shares, real estate, and currency risk. First Canadian’s market risk arises through its investing activities. To help mitigate this risk the Company’s Investment Policy has established criteria specific to credit quality and exposure limits. The Company’s surplus capital is weighted in preferred shares and equities and the fair value of these investments are directly obtained from the general market.

Insurance Risk: Is the risk of loss arising from the frequency of claims, duration of claims or the benefit payment exceeding what is expected. First Canadian’s insurance risk is sensitive to morbidity incidence, and lapses occurrence. Mortality, morbidity termination and expense experience complete the insurance risk exposure. All insurance risk is located in Canada and the policies and coverage term are of short durations. The Company uses various reinsurance strategies to mitigate its insurance risk exposure.

Credit Risk: Is the potential for a financial loss arising from the potential default of a counterparty or the deterioration in a counterparty’s credit worthiness. First Canadian’s credit risk is specific to its receivables, recoverable assets and other assets where the counterparty may experiences financial difficulties and is unable to pay its obligation as they come due. To help mitigate this risk the Company’s Lending Policy has established criteria related to credit quality, exposure limits and collateral requirements. The Company actively manages its past due receivables.

Operational Risk: Is the potential for loss resulting from inadequate or failed internal processes or controls; human error and failed systems; or from external events and includes legal risk but excludes strategic risk and reputational risk. First Canadian’s operating risk is mitigated by implementing policies and procedures directed at identified risks; employing knowledgeable and experienced senior managers and qualified professionals; segregation of duties among employees; and through engagements with the Parent’s department of Internal Audit. Senior management is responsible for defining the framework for identifying risks and developing the appropriate risk management policies. The Board of Directors, both directly or through its committees, reviews and approves key policies and implements specific reporting procedures to enable them to monitor compliance over significant areas of risk.

Diversification Credit: Is an offset against risk aggregation. Risk aggregation is the sum that each adverse risk event, viewed individually in isolation from other identified risks, are correlated to the adverse event. A diversification credit results due to the uncorrelated nature of above risks, the diversity of the Company’s business lines and the broad geographical distribution of Company’s policy holders.

Regulators scalar: As determined by OSFI a 5% scalar adjustment is applied to the sum of the above identified risks less the diversification credit.

More information about the LICAT may be found on OSFI’s website Guideline “A”, Life Insurance Adequacy Test:

http://www.osfi-bsif.gc.ca/eng/fi-if/rg-ro/gdn-ort/gl-ld/pages/licat19_index.aspx

2024 © First Canadian Financial Group. All Rights Reserved.

Regulatory Disclosures | Privacy Policy | Legal Notice | Complaints |

Code of Conduct Policy | Contact Us